U.S. stocks closed lower Friday, with health care and tech stocks lagging, amid continued uncertainty ahead of next week's scheduled Brexit vote.

The Dow Jones industrial average lost 1.07 percent for the week, its worst since the one ended May 13. The S&P 500 lost 1.19 percent for the week and the Nasdaq composite fell 1.92 percent for the week.

"The market's down 1 percent (this week) so it isn't a good week, but there's a tension between event risk ... and profit trends that are starting to look a little better," said Jeremy Zirin, head CIO investment strategist at UBS Wealth Management Americas.

The Dow closed about 59 points lower after briefly falling 130 points. Apple and Merck had the greatest negative impact. Health care closed 1.1 percent lower to lead S&P 500 decliners, followed by a 0.9 percent fall in information technology.

Apple closed near session lows, off almost 2.3 percent after news intellectual property regulators in Beijing barred the tech company from selling models of the iPhone 6 and 6 Plus in the city, citing strong similarity to an existing Chinese phone. Apple said in a statement to CNBC it is appealing the ruling and that the phones are available for sale today in China.

The iShares PHLX Semiconductor ETF (SOXX) closed 0.85 percent lower for its first six-day losing streak since the one ended early January.

The Nasdaq composite and S&P 500 had their worst weeks since the one ended April 29. Telecommunications and utilities were the only gainers on the week.

The Dow transports closed more than half a percent higher Friday but fell 2.25 percent for the week, ending in correction territory, or more than 10 percent below its 52-week intraday high. The Russell 2000 lost more than 1.5 percent for the week, its worst since early April.

"I think there are a lot of distractions in the markets this week. Obviously a lot of focus on the (EU) referendum and interest around the very dovish sentiment expressed by the Federal Reserve," said David Kelly, chief global strategist at JP Morgan Funds. "I think that's got the market really confused here."

The U.K. vote on whether to leave the European Union is scheduled for next Thursday.

"The reality is markets regard Brexit as being a source of big uncertainty," Kelly said. "I have to say the implications for the global economy and financial markets are probably smaller than people think. ... It's important to recognize central banks and major governments are strongly in favor of Britain remaining in the EU."

The Federal Reserve kept rates unchanged at its meeting this week and Fed Chair Janet Yellen said Brexit concerns were a factor in the decision. The latest central bank statement came after the weak May jobs report.

In a significant shift in economic views, St. Louis Fed President James Bullard said low growth and a very low fed funds rate of just 63 basis points will likely remain in place through 2018, implying just one more hike until that time.

In economic news, housing starts declined 0.3 percent in May, while building permits rose 0.7 percent.

"This week's economic news was not all that bad but certainly it doesn't point to the economy exploding to the upside anytime soon," said Peter Cardillo, chief market economist at First Standard Financial.

Friday also marked options expiration. The third Friday of every March, June, September, and December is quadruple "witching," the expiration of three related classes of options and futures contracts, along with individual stock futures options.

Treasury yields were higher, with the higher around 0.69 percent, after hitting its lowest since mid-February on Thursday. The 10-year yield around 1.61 percent, after touching its lowest since August 2012 on Thursday.

The U.S. dollar index was about 0.4 percent lower, with the euro around $1.128 and the yen near 104.2 yen versus the greenback. Sterling was higher against the dollar near $1.436.

U.S. stocks came off lows Thursday and closed higher, as the British pound recovered losses against the U.S. dollar to trade higher. Gold also came off session highs. The move in sterling coincided with news Britain temporarily suspended campaigning on the Brexit vote after a Labour member of Parliament was shot and killed. The cause of the shooting was unclear, but there was speculation the act could encourage more voters to choose to remain in the EU.

Britain's parliament will be recalled on Monday to allow lawmakers to pay tribute to the slain legislator, the leader of her party Jeremy Corbyn said Friday. He was speaking alongside Prime Minister David Cameron near the spot of the shooting.

Parliament has not been sitting since Thursday, to allow lawmakers to campaign ahead of a referendum on EU membership on June 23.

"My sense is there's more of a chance the U.K.'s going to stay. That might be a catalyst (for stocks to come off session lows)," said Mike Bailey, director of research and chair at FBB Capital Partners.

"The only other major driver here today is oil. Oil's back in a big way," he said.

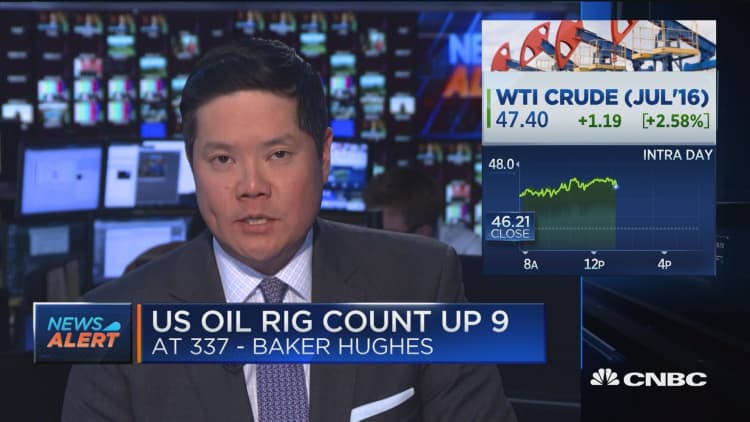

Energy was the top performing sector on the day and down mildly for the week. U.S. crude oil futures snapped a six-day losing streak, settling up $1.77, or 3.83 percent, at $47.98 a barrel. WTI fell 2.2 percent for the week, its worst since early May.

The weekly oil rig count rose for a third-straight week with a gain of nine, according to Baker Hughes.

On Friday, the major European indexes were up nearly 1 percent or more. The Euro STOXX 600 Banks index outperformed, closing more than 4 percent higher for its best day in about two months. However, the index was down nearly 1.4 percent on the week for its first three-week losing streak since the one ended in early April.

Asian stocks closed higher, with the Nikkei 225 up more than 1 percent and the Shanghai composite about 0.4 percent higher.

The Nikkei 225 fell more than 6 percent for the week, its worst since the one ended February 12. The Shanghai composite had its second-straight weekly decline with a fall of 1.44 percent.

The Dow Jones industrial average closed down 57.94 points, or 0.33 percent, at 17,675.16, with Merck leading decliners and Caterpillar the top advancer.

Verizon was the top performer on the week, while American Express was the greatest laggard.

The closed down 6.77 points, or 0.33 percent, at 2,071.22, with health care leading five sectors lower and energy the top advancer.

Telecommunications was the best performer on the week, while health care was the worst.

The Nasdaq composite closed down 44.58 points, or 0.92 percent, to 4,800.34. Apple fell 3.5 percent for the week. The iShares Nasdaq Biotechnology ETF (IBB) lost 4.2 percent for the week.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, traded lower near 19.3. On Thursday, the VIX hit 22.89, its highest since February 19.

About three stocks advanced for every decliner on the New York Stock Exchange, with an exchange volume of nearly 2.1 billion and a composite volume of 4.7 billion in the close.

High-frequency trading accounted for 49 percent of June's daily trading volume of about 6.75 billion shares, according to TABB Group. During the peak levels of high-frequency trading in 2009, about 61 percent of 9.8 billion of average daily shares traded were executed by high-frequency traders.

Gold futures for August delivery settled down $3.60 at $1,294.80 an ounce, its first negative day in eight after hitting a nearly two-year high intraday Thursday. The precious metal gained nearly 1.5 percent for the week, its first three-week win streak since the one ended February 12.

—Reuters contributed to this report.