Seattle's rich should engage in upper-class "civil disobedience" and refuse to pay their city taxes, Washington state's Republican leaders said.

After the city of Seattle passed a new income tax on households earning more than $500,000, the Washington State Republican Party called for taxpayers to "forcefully resist" the tax by refusing pay, file or comply with it.

"It deserves nothing less than civil disobedience," the state GOP said in a statement.

Last week, Seattle's city council passed a 2.25 percent tax on income above $250,000 for individual filers and income over $500,000 for couples. Washington state has no personal income tax, and until Seattle's tax, no city in the state collected income tax.

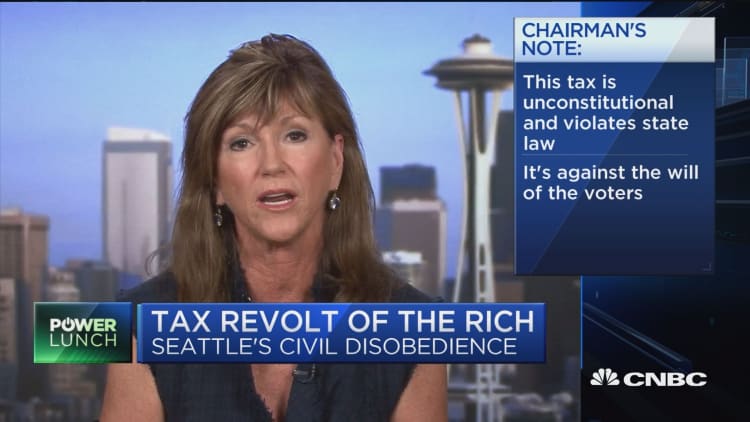

State GOP Chairman Susan Hutchison told CNBC there is a "tax fatigue" among everyone in Washington, not just the rich.

"We are so taxed, despite not having an income tax. Our property taxes are sky high and we have the highest sales tax in the country. In fact, we are one of the most highly taxed states in the entire country per capita. So adding an income tax is a huge burden and everyone is feeling it," she said in an interview with "Power Lunch" on Wednesday.

Seattle is seeing a massive wealth boom from growing tech companies like Amazon and Microsoft, yet the gains aren't being spread evenly. Soaring housing prices are squeezing out middle-class families and lower-income earners from many neighborhoods and creating a shortage of affordable housing, local officials say.

Seattle's outgoing mayor called the tax "a new formula for fairness."

The city estimates the tax will raise $140 million a year, which it says it will use to replace money lost from federal budget cuts that would adversely affect cities.

Yet the tax is certain to face a court challenge. State Republican lawmakers say the tax is unconstitutional and violates state law, arguing the city doesn't have the right to impose taxes. They add that while the tax is aimed at the wealthy, it is a "thinly veiled attempt to test the state constitutional limits of an income tax for all."

"This is really a power grab and it's a phony bill because the whole intention is to take it up to our state supreme court to overturn the constitutionality of the no income tax that has been the tradition of our state, as well as state laws," Hutchison told CNBC.

During a news conference urging the wealthy to refuse to pay the tax, Hutchison was drowned out by opponents shouting and holding signs that read "Tax the Rich."

One study found that the city has among the most regressive tax burdens in the country, with low-earners paying a much larger share of their income on government fees.

The study, by the District of Columbia's chief financial officer, found that among families earning $25,000 a year, Seattle had the fourth-highest tax burden among 51 cities when it comes to taxes paid for income, property, sales and automobile. Yet for those making more than $150,000, Seattle is the fourth lowest in the country.

Even if the tax survives a court battle, many top earners in Seattle might move to the nearby suburbs to avoid paying the tax. The two richest men in the world — Bill Gates and Jeff Bezos — live in nearby Medina, which is not part of the city of Seattle.

WATCH: Washington GOP chair says Seattle tax a farce