The top Senate tax writer on Friday cast doubts on President Donald Trump's goal of slashing the corporate tax rate to 15 percent.

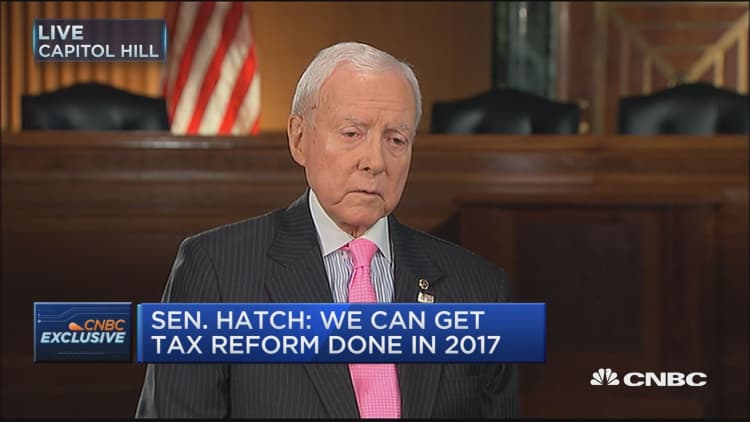

"Well, the president wants it down to 15 percent. That would be wonderful if we could get it down there," Sen. Orrin Hatch, R-Utah, told CNBC. "We'll be working to try to do that. I sincerely doubt that we'll be able to get to that level on the corporate tax rates."

Hatch, chairman of the Senate Finance Committee, is one of the so-called Big Six congressional and White House officials leading the Republican tax reform effort. The GOP hopes to pass a major tax overhaul this year, an effort that Hatch admitted will be "complex."

Hatch, the longest-serving Republican senator, believes passing a tax reform plan this year is realistic.

"I actually believe we know enough about it that we can do this in 2017. But it's going to take a lot of cooperation of both Democrats and Republicans," he said.

On Thursday, Hatch's committee held a hearing on individual tax reform. The panel will have another hearing on overhauling the corporate system next week.

Congressional Republicans aim to release more details about their still-evolving plan later this month. The GOP has not publicly released many specifics of a possible bill, beyond a joint statement from the Big Six and a one-page outline from the White House earlier this year.

Broadly, the GOP has pledged to craft a plan to chop individual income and corporate tax rates, encourage corporations to bring back cash parked overseas and eliminate most deductions. Trump and Republican leaders have pitched tax reform as essential to boosting economic growth.

On Friday, Hatch said, "We're all trying to get on the same page." He admitted that overhauling the tax system is harder than passing a health-care plan, which the GOP failed to do earlier this year.

"It's much harder than health care," the senator said.

Hatch is not the only one of the Big Six this week to temper expectations for a 15 percent corporate tax rate. On Tuesday, Treasury Secretary Steven Mnuchin said the goal would be difficult to achieve.

WATCH: Tax reform has to be bipartisan: Brookings Institution's Aaron Klein