The estate tax — addressed differently in the House and Senate tax overhaul bills — discourages savings, Sen. Chuck Grassley told CNBC on Tuesday.

"Death ought to not be a reason for having taxation. The people who saved are then punished," the longtime Iowa Republican said on "Squawk Box."

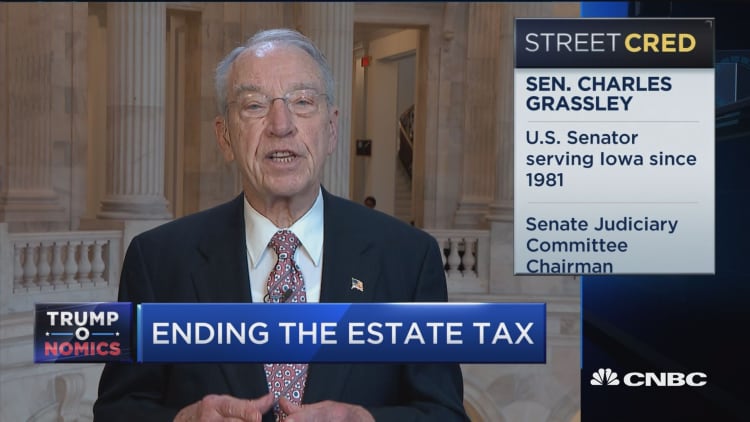

Grassley was chairman or ranking member of the Finance Committee for nine years through 2010. He remains a senior member of that tax-writing panel. He's also currently chairman of the Judiciary Committee. Grassley, a lifelong family farmer, has been a senator since 1981.

"We have so much in our tax code that encourages savings, he said. "But the estate tax works against that."

The Senate tax bill, which was passed early Saturday, mitigates the impact of the estate tax by doubling the exemption. The current exemption is $5.49 million for an individual and $10.98 million per couple.

The House, which passed its tax legislation last month, takes a similar approach, but goes a step further and repeals estate taxes altogether in 2024.

The treatment of the estate tax is an item that conference committee members are going to need to figure out as they work to craft and pass compromise legislation that can go to President Donald Trump for his signature.

However, on Monday, Grassley found himself defending comments over the estate tax that were published over the weekend as part of an interview in The Des Moines Register, Iowa's biggest newspaper.

Grassley was quoted as saying: "I think not having the estate tax recognizes the people that are investing ... as opposed to those that are just spending every darn penny they have, whether it's on booze or women or movies."

Critics were quick to say comments like these that suggest people struggling to make ends meet are wasting their money show that Republicans are out of touch with working Americans.

In a statement, Grassley said, "My point regarding the estate tax, which has been taken out of context, is that the government shouldn't seize the fruits of someone's lifetime of labor after they die."

"The question is one of basic fairness, and working to create a tax code that doesn't penalize frugality, saving and investment," he added.

"That's as true for family farmers who have to break up their operations to pay the IRS following the death of a loved one as it is for parents saving for their children's college education or working families investing and saving for their retirement," Grassley explained.