Even with Disney's strong second-quarter earnings report, boosted by theme park success and multiple blockbusters, CNBC's Jim Cramer has noticed that investors still overlook its stock.

"No one seems to care that Disney's movies keep breaking records," the "Mad Money" host said about its Avengers and Black Panther films. "Throw in the fact that the company's been a voracious buyer of its own stock, and it's downright puzzling, frankly, that this market only seems to focus on one thing: subscriber losses at ESPN."

So Cramer called on technician Tim Collins, his colleague at RealMoney.com, to help him understand how Disney's technical indicators were factoring into its share price.

And "as Collins sees it, there are few animals more unloved on Wall Street than Mickey Mouse," Cramer said Tuesday.

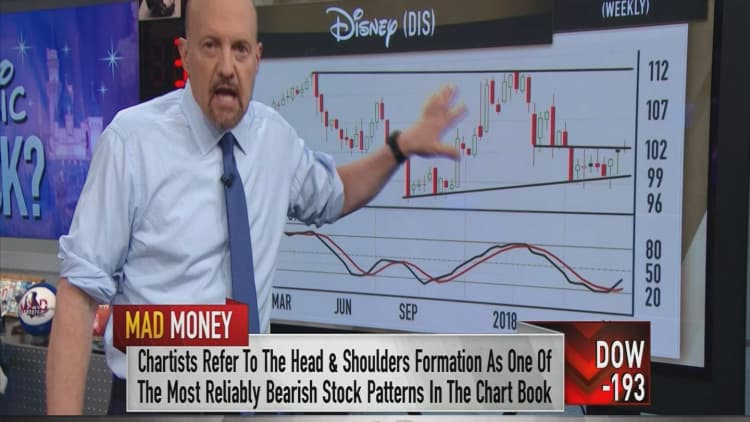

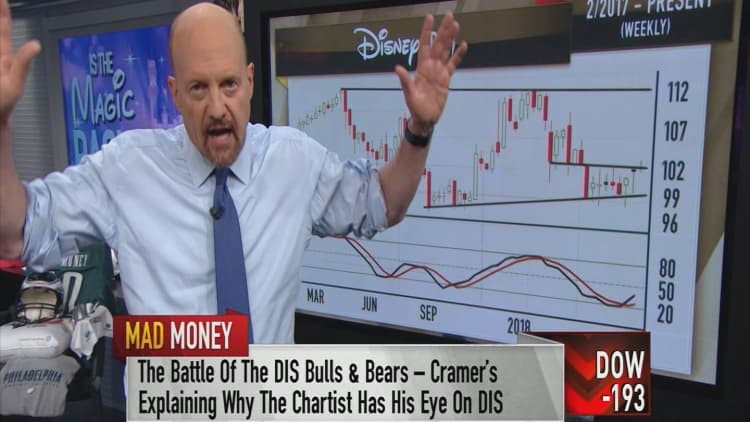

Collins began by looking at Disney's weekly chart. Right away, he saw that the chart was showing one of the scariest formations in the book: a head-and-shoulders pattern.

This pattern, which looks like a higher peak in between two lower peaks, tends to freak technicians out because it's so reliably bearish, Cramer said.

"According to Collins, the neckline of this pattern sits at $99 and extends all of the way back to last September," he explained. "The idea behind this thing is that if Disney breaks down below $99, it could potentially have another dozen points of downside before it finds its footing."

But for Collins, the $99 level represented a clear signal for investors: if Disney's stock dips below it, then it's time to sell the stock.

"In fact, he thinks you should actually wait until it pulls back below $98, just in case it overshoots to the downside before bouncing," Cramer said. "Basically, this head-and-shoulders pattern means that if you buy Disney, he thinks your risk is well-defined. And given that the stock is currently just under $103, your potential losses could be contained if you take Collins' advice."

Better yet, Collins argued that Disney's stock is close to breaking out of its head-and-shoulders pattern. If the stock can rally $1 per share from its current levels, Collins figured Disney's short-sellers would have to buy back their shares, ending the bearish move and boosting the stock.

The technician also pointed to Disney's full stochastic oscillator, which detects whether a stock is overbought or oversold, at the bottom of the chart.

A few weeks ago, the stochastic oscillator made a bullish crossover — when the black line goes above the red — signaling that shares of Disney could be due for a bounce, Cramer said.

"When the stochastics did this same thing last July, ... the stock caught a small pop. When they did it again in October, well, then it got a huge move higher," he recalled. "We're talking about rallies of 5 percent and 10 percent, respectively."

"Put it all together and Collins' near-term target for Disney is $108, with a probable retest of the stock's $112 high before the end of the year, possibly even before autumn," Cramer said.

Disney's daily chart supported Collins' analysis. The stock broke through its $102.75 ceiling of resistance in Tuesday's final hours of trading, and Collins said that level was critical for the bulls.

"As Collins sees it, Disney has very well-defined risk-reward: if the stock goes below $98, the bulls lose and he wants to be a seller because he thinks that could signal a much bigger breakdown," Cramer said. "But above $103, just 8 cents [up] from here, and he expects Disney to give you a big breakout to the upside."

All in all, Collins' view is that "Disney, the happiest place on Earth, is ready to make the bulls some of the happiest traders in the market," the "Mad Money" host said. "As for me, I'm a huge fan of Disney, and while I like it just fine here, personally, I've got to tell you something: if it does get hit because of any of this technical stuff, call me a buyer."

WATCH: Charts show bullish signs for Disney, technician says

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com