As restaurant stocks rise in lockstep with consumer sentiment and job growth, CNBC's Jim Cramer recruited technician Bob Lang to find the best investments in the dining space.

Lang, the founder of ExplosiveOptions.net and part of TheStreet.com's Trifecta Stocks newsletter team, found three fast-casual chains doing particularly well: Chipotle, Del Taco and El Pollo Loco.

"At a time when some people have been worried about rising raw costs and increased competition, ... these three companies have been putting on a pretty good show," Cramer said on Monday.

So, to explain why Lang thought all three stocks could outperform the broader restaurant sector in the near term, the "Mad Money" host turned to Lang's technical analysis.

Chipotle Mexican Grill

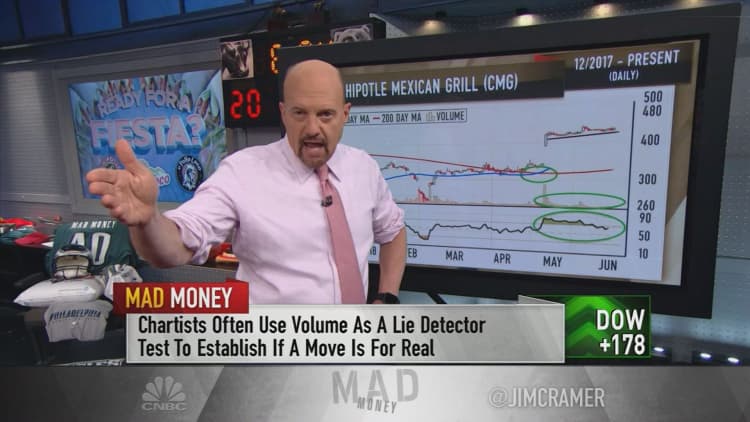

The once-left-for-dead Chipotle has been making a serious comeback after two food safety incidents — an E.coli outbreak in 2015 and a norovirus outbreak in 2017 — crushed the stock.

When the market sold off in early February, Chipotle's shares finally managed to bottom in the $240s. Since then, the stock has been roaring, boosted by a strong quarterly report in April.

Lang pointed out that the stock's Relative Strength Index, a tool that tracks momentum, has been extremely positive since the company's April 25 earnings report.

He also noted some favorable volume trends: Chipotle's stock is no longer overbought, meaning that it could be ready for another run higher, and each recent rally has occurred on strong volume, meaning that the stock's latest moves higher have been "the real deal," Cramer said.

"In the end, Chipotle is Lang's favorite stock in the group here, and he thinks that this $443 stock can rally to $480 and then perhaps even [to] $500 in the not-too-distant future," Cramer said.

Del Taco Restaurants Inc.

Like Chipotle, shares of Del Taco, a small-cap, more speculative Mexican food chain, have recovered handsomely since their March lows, gaining nearly 25 percent.

Lang liked the strength he saw in this chart's Relative Strength Index. More importantly, he liked that Del Taco's moving average convergence-divergence indicator, which predicts changes in a stock's trajectory before they happen, made a bullish crossover in April.

The crossover, depicted by the black line in the chart above crossing over the red one, sent shares of the 300-restaurant eatery even higher.

"But Lang believes that Del Taco could have even more upside," Cramer said. "While the stock is approaching the ceiling of resistance from where it gapped down in March — at $12.50, right near the 200-day moving average — Lang believes it can make a run at that level and then push higher."

"As he sees it, the path of least resistance takes Del Taco to just under $14. That's roughly 13 percent from these levels," the "Mad Money" host added. "I like that call."

El Pollo Loco Holdings Inc.

For fellow small-cap Mexican chain El Pollo Loco, Lang used the stock's weekly chart. Shares of El Pollo Loco recently made a run at their 50-week moving average, met their ceiling of resistance, then abated. But according to Lang, there was more to that move than met the eye.

"Based on the action here, Lang thinks this could be a wildcard for upside," Cramer said. "Why? Well, El Pollo Loco recently made a higher low — that's a good sign — and the volume trends have been improving, ... meaning the volume is higher on up days than down days."

"Meanwhile, the Relative Strength Index, RSI, keeps climbing, and in April, the moving average convergence-divergence indicator made that bullish crossover," he continued.

All in all, Lang thought that by the end of this year, El Pollo Loco's stock could push above its ceiling of resistance and rally to its 2017 highs of around $15.

Conclusions

Despite Chipotle's share-shattering scandals and Del Taco and El Pollo Loco's comparatively speculative situations, Cramer and Lang agreed that this dining sub-cohort's bounce was worth watching.

"After spending a long time in the wilderness, these Mexican restaurant chains have been making some remarkable comebacks here," the "Mad Money" host concluded. "The charts, as interpreted by Bob Lang, suggest that Chipotle, Del Taco and El Pollo Loco still have plenty of upside here and I think he's got a strong case. That said, Chipotle is the only one of these three that's not extremely speculative, so please be extra careful with the other two."

WATCH: Cramer's charts taco 'bout Mexican food stocks

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com