J.P. Morgan Asset Management chief executive Mary Erdoes and State Street Global Advisors CEO Cyrus Taraporevala believe a worsening trade dispute between the U.S. and its economic allies could become the single largest problem for the Federal Reserve.

Noting that trade disputes and tariffs tend not only to buoy prices throughout the global economy, but also to hamper economic growth, the two financial leaders said that those forces, acting simultaneously, may pose a dilemma for Fed officials, including Chairman Jerome Powell, looking to normalize historically low interest rates.

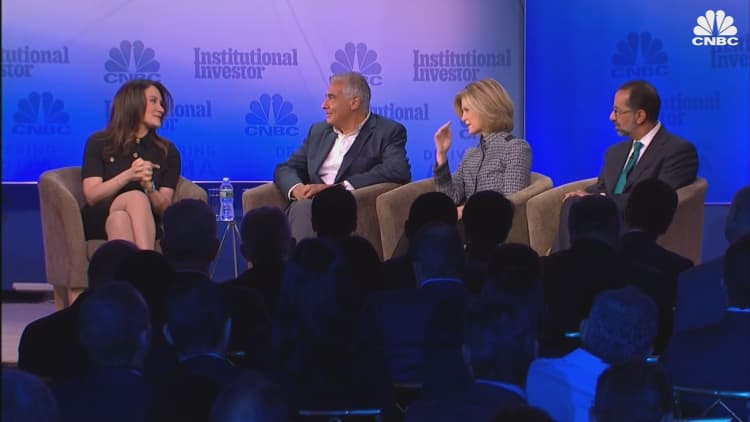

“I think that’s the big conundrum and I think that’s what Chairman Powell has basically signaled,” Taraporevala said at the Delivering Alpha Conference in New York last week. “The single biggest risk he sees is, in fact, if it does escalate into a trade war.”

President Donald Trump and his administration have defended an initiative of “fair and reciprocal” trade throughout his tenure, demanding that some of the nation’s economic allies offer the U.S. a better deal in an effort to curb Washington’s trade deficit and promote American exports. The White House has also imposed taxes on imports from countries like China as a means of forcing allies to re-examine longstanding trade deals.

Since January 2017, the United States has imposed tariffs on $79 billion of goods and services and proposed an additional $702 billion on others foreign goods in an effort to force key trading partners to renegotiate trade agreements.

“It will be inflationary. There’s almost no way it won’t be inflationary,” said Erdoes. "When you think of tariffs on China, you have to think through: If you put tariffs on the computer industry in China, you’re only hurting — 15 percent of the companies there are Chinese. Eighty-five percent of them are U.S. and other multinationals that are going to be hurt."

"So what does that do?" Erdoes asked. "What does it do to the rest of Asia? What does it do to U.S. companies that don’t have pricing pressure? Could they raise their prices? Now you have other inflation and so you cascade into these second or third derivatives, which is the hardest thing for people to think through.”