Republicans aiming to push through another tax plan are wasting their time, GOP Rep. Leonard Lance told CNBC on Friday.

House Republicans hope to hold a floor vote on the second stage of its tax reform later this month. The legislation will aim to make individual cuts, which were passed last year, permanent. But the most controversial aspect is the $10,000 cap on state and local tax deductions, which would also become permanent.

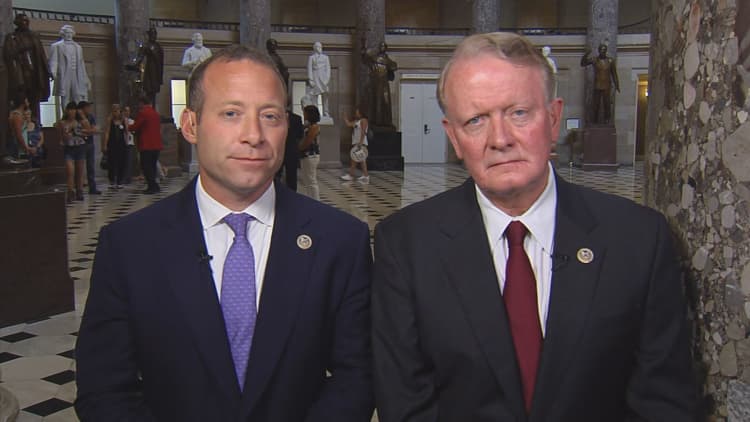

Lance, a moderate Republican who represents the 7th district in New Jersey, is against that cap and did not vote for the GOP bill the first time. New Jersey has some of the highest taxes in the nation.

"I favor lowering corporate taxes. We have to be competitive with the rest of the world and I also favor complete deductibility of state and local taxes," he said on "Power Lunch."

"If we were to pass that here in the House it would be an exercise in futility because it could never pass in the Senate," he added.

The measure needs 60 votes to pass the Senate and therefore would require at least nine Democrats to back it.

"That is not going to happen," said Lance.

The latest plan, known as tax cut 2.0, comes just months before the midterm elections. Republicans are trying to hold onto their majority in the House. In order to flip the chamber, Democrats would have to win at least 23 Republican-held seats. Lance's district is considered a toss-up.

Rep. Josh Gottheimer, D-N.J., also voted against the GOP tax reform bill and called the move to make the state and local tax cap permanent a "terrible idea." Before Trump's tax reform, those so-called SALT deductions were unlimited.

"I support cutting corporate tax rates but the problem is it was done on the backs of state like ours in Jersey, where it's had a significant impact," he told "Power Lunch." "It's been a tax hike on our residents."

Gottheimer, who represents the state's 5th district, said average taxes in Bergen County are $24,000.

That's why he had proposed a workaround: allow residents to declare property taxes as charitable donations. Earlier this year, it became law in New Jersey but the Treasury Department and IRS recently issued new rules to block attempts to circumvent the SALT cap.

"We knew they were going to go to court over this," Gottheimer said. "Now we got to fight it out. I think we win. The courts have been clear about this. This is a deduction we should be able to take."

Voters have yet to embrace tax reform, the GOP's signature achievement. About 37 percent of registered voters approve of the law, versus roughly 42 percent who disapprove, according to a RealClearPolitics average of polls.

— CNBC's Jacob Pramuk contributed to this report.