The U.S. stock market shook off the recent sell-off and rose sharply on Tuesday, but that doesn't necessarily mean it's time to celebrate yet, trader Matthew Cheslock told CNBC.

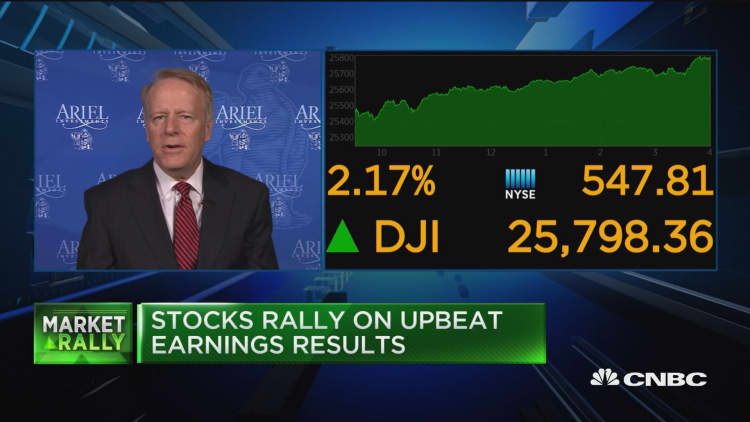

The Dow Jones Industrial Average closed up more than 500 points on Tuesday. However, Cheslock pointed out that the blue-chip index hasn't regained all it lost in the recent sell-off.

"We're not out of the woods yet," he said on "Closing Bell."

Cheslock, an equity trader at Virtu Financial, said markets were oversold after last week's rout so equities are now being bought.

"It doesn't really give us an indication if the market is going to go higher or hit all-time highs. This is probably some kind of smaller bounce in between," he noted.

Last week's sell-off was brought about, in part, by concern over rapidly rising interest rates and a possible global economic slowdown. The major indexes suffered their worst weekly loses since March.

On Tuesday, the Dow posted its best day since March after positive earnings reports from some of the largest U.S. companies.

The Dow is now up 3 percent from last week's lows thanks to Tuesday's gains and Friday's rally.

Charlie Bobrinskoy, head of the investment group at Ariel Investments, said earnings are going to reassure investors.

"People have continued to underestimate earnings all year long. People have understated the impact of taxes, underestimated the health of the economy," he told "Closing Bell."

"There is a lot of leverage in corporate America, where you get a little bit of a better increase in revenue than you expect and more of that falls to the bottom line."

Among those reporting earnings after the bell on Tuesday was Netflix. The streaming company beat expectations, which sent shares surging.

Before the bell, bank earnings also came in strong. Morgan Stanley, which ended the day 5.7 percent higher, reported better-than-expected results and Goldman Sachs closed up 3 percent after announcing profits that beat estimates.

However, shares of IBM fell in extended trading Tuesday after it missed revenue estimates.

— CNBC's Fred Imbert contributed to this report.