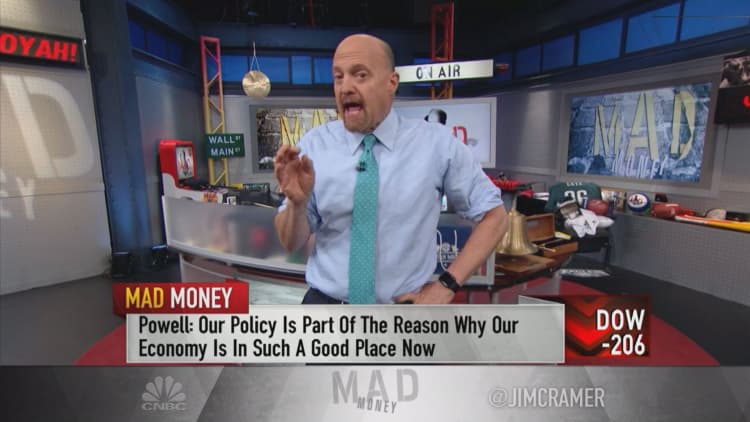

Federal Reserve Chairman Jerome Powell's comments about the U.S. economy on Wednesday may have been the central bank chief's first real acknowledgment of an economic slowdown, CNBC's Jim Cramer says.

"It's the first time that I've actually heard Jay Powell say, 'You know what? We've got to be careful, because there are signs of the economy slowing,' whether it be because of tariffs, whether it be just because genuine economic activity seems to be cooling off," Cramer told investors on "Mad Money."

During a question-and-answer session in Dallas, Powell conceded that the global economy is not growing at the same pace it was last year, but said that overall, the domestic picture looks good. He described the global layout as gradually "chipping away" at the pace of growth but said it is "not a terrible slowdown."

To Cramer, Powell's remarks "basically amounted to a realization" that the Fed's interest rate hikes are affecting the U.S. economy.

"If you're thinking that way, you're not going to be thinking, 'You know what? I'm going to slap on a rate increase in December, and then I'm going to just add three more blindly in 2019,'" Cramer said.

"He gets that the tightenings have had an impact and that maybe he shouldn't keep tightening, because the impact is going to get worse and worse and worse for the economy," the "Mad Money" host continued. "And he said he did not want to be responsible for setting us back."

Powell has been a target of criticism from Cramer and from President Donald Trump for the Fed's aggressive plan to hike interest rates to a level where they are neither accommodative nor restrictive to the economy. The central bank is expected to hike interest rates once more in December and three times in 2019.

But even Powell's newfound sense of caution doesn't guarantee that the central bank won't continue to raise rates to economically crippling levels, Cramer warned.

"I need everybody to think that things are going to be awful," he said. "The bear market that everyone is talking about? Well, it's got to be universally accepted and people have to keep leaving. And if they don't, then what's going to happen is someone's going to say, 'You know what? I heard Powell. I'm going to stay in.' Every weak hand has to go."

The major averages endured another day of declines Wednesday as weakness from shares of Apple and the banking sector weighed on the broader market.

— CNBC's Jeff Cox contributed to this report.

Disclosure: Cramer's charitable trust owns shares of Apple.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com