All in all, November isn't shaping up to be much better than October. The Nasdaq Composite Index fell back into correction territory on Monday, pulled down by major tech stocks.

Concerns about overblown valuations have hurt the sector over the last couple of months, with the pain spread across chip stocks, software stocks as well as the so-called FAANG heavyweights.

But there are still some names top Wall Street analysts are sticking by and telling clients to add.

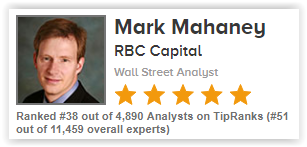

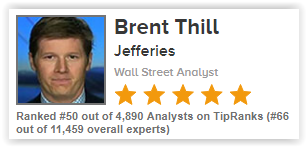

Using TipRanks we dialed down into top analysts' favorite names from the sector right now. TipRanks uses a natural language-processing algorithm based on proprietary AI technology to rank analysts on two factors:

- Average return of buy-sell recommendations

- Success rate of buy-sell recommendations

We used this in conjunction with TipRanks' Analysts' Top Stocks tool, to identify the tech stocks which have received the most bullish recent ratings from the Street. The tool also reveals which stocks have dropped over the last three months- enabling us to pinpoint the best stocks trading at compelling levels.

Here are the best-performing analysts' five favorite tech stocks right now: