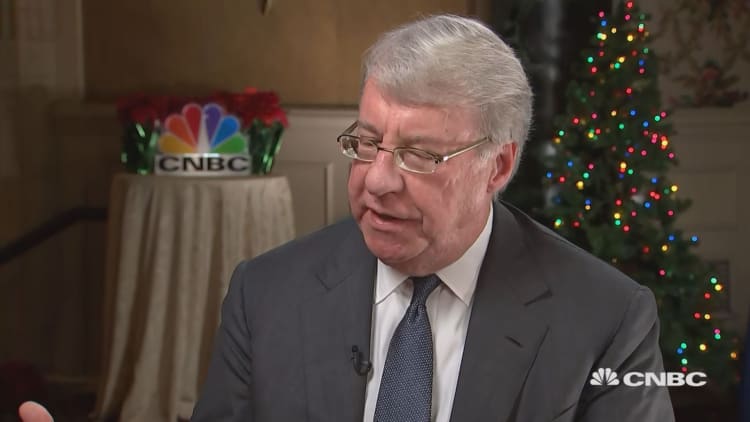

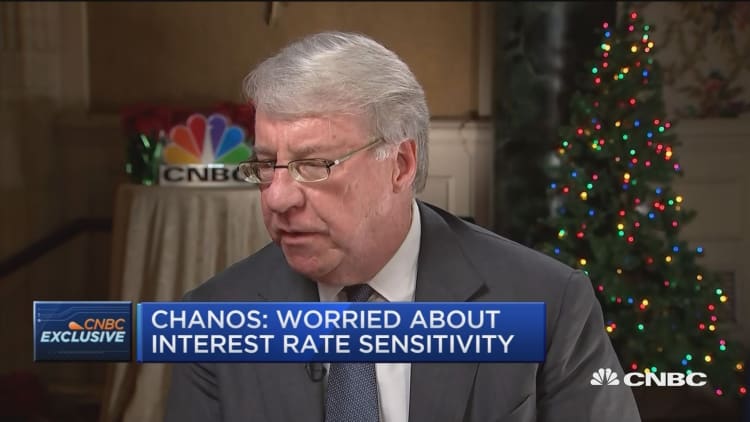

Famed short-seller Jim Chanos is going after American casino operators Las Vegas Sands and Wynn Resorts as the U.S.-China trade war continues.

"One area I'm scratching my head about is the Macau casino guys," Chanos told CNBC's Sara Eisen on Thursday. "We're basically short the U.S. guys ... Wynn and Las Vegas Sands, particularly their Hong Kong-listed Asian operations. In our hedge fund, we're actually long the Chinese operators."

"Whatever your views are on Macau, the U.S. operators trade at a premium to the Chinese operators. While that has always been the case, I think in light of the trade tensions, that doesn't make a lot of sense right now," he said. "At the very least, the U.S. operation should trade at a discount."

Shares of both companies fell to their lows of the day on Chanos' comments, aired on CNBC. Las Vegas Sands closed 0.6 percent lower, and Wynn declined 1.2 percent.

Chanos' comments come after China and the U.S. have slapped tariffs on billions of dollars worth of their goods. The two countries are trying to negotiate a new trade deal, but the uncertainty surrounding those talks has sent investors into a tailspin. The S&P 500 is trading about 10 percent below an all-time high it reached on Sept. 21.

The hedge-fund manager also said a prolonged trade war "could happen and is not being priced in the stocks" of companies such as Las Vegas Sands and Wynn. He also said Chinese authorities hold "all the cards" when it comes to these companies' licensing in Macau. "They literally could put these guys out of business."

Chanos told Eisen he has been short these stocks since this summer.

Chanos founded Kynikos Associates in 1985 and has more than $2.1 billion in assets under management, according to an SEC filing.