As the U.S. and China negotiate on trade, Beijing is working overtime, pulling multiple levers to steady its lagging economy and boost markets.

China's central bank on Wednesday injected a record $83 billion into the financial system, seeking to avoid a cash crunch. The move is the latest in a series of stimulus efforts by Chinese officials, who have been working to assure investors that more spending and other types of policy support would be forthcoming.

Premier Li Keqiang on Wednesday acknowledged the economy faces difficulties and said the government aims to keep growth within a reasonable range through further stimulus.

In some regards, that could tip the scale eventually in trade talks. Officials in President Donald Trump's administration have said China's weak economy is a factor that has brought Beijing's negotiators to the table. But economists expect China's economy to stabilize by the middle of the year, around the time some expect U.S. growth to head lower, to a rate of just under 2 percent after a first-half pace of closer to 2.5 percent.

"China has shifted gears, introducing a steady drumbeat of new stimulus measures. Meanwhile US fiscal policy is stuck in gridlock and the shutdown is actually causing a modest tightening of policy," wrote Bank of America Merrill Lynch economists in a recent note. The Fed has shifted from rate-hiking mode to a more cautious stance, "but it probably needs to see clearer signs of weakness before it cuts rates."

Weaker U.S. growth is coming as the effects of the massive tax cuts and other stimulus begin to fade, leaving the Trump administration with fewer bullets. With the Fed's easier posture, markets now see the potential for no rate hikes at all out across the next year.

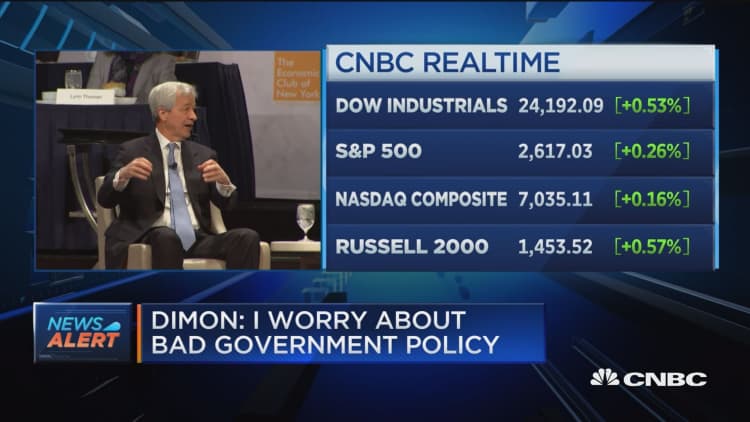

"Now you have a slowdown, and I think it's probably a slowdown as opposed to you're on the way to a deep recession," said J.P. Morgan Chase CEO Jamie Dimon. "China is probably the most serious one, and the one with the most ramifications for the rest of the world, because China growth at 5 percent is $600 billion GDP growth in the world."

Dimon, speaking at the Economic Club of New York on Wednesday, said China is able to push policies in a way the U.S. cannot.

"The thing about China is they have the wherewithal," he said. "They can macro manage in a way you can't do in the United States. There's seven people that control the nation."

China's ability to push its policies "kind of works. It will work for another five years, 10 years," Dimon said. "They're trying to work that through to keep jobs, peace, prosperity. Now my view is they'll accomplish that in the next couple of years."

Source: Capital Economics

Whether China's ready use of stimulus will help lead it to a strong posture in trade talks has yet to be seen.

"The direct impact of tariffs on China's economy so far is hard to identify," said Mark Williams, chief Asia economist at Capital Economics. Williams said Chinese exports to the U.S. have held up fairly well, a trend that could change, but U.S. exports to China have fallen off sharply.

Even with a slowing U.S. economy, Williams said it's not clear the Chinese will have a much stronger bargaining position. "I'm a little bit skeptical," he said, noting that Chinese exports don't contribute meaningfully to the U.S. economy except for some sectors, such as soybean farmers.

"They are not a big reason why the U.S. economy is slowing. I don't think it gives China a lot of leverage," Williams said. "What might matter more to President Trump is whether the S&P and the U.S. stock market is falling sharply. That might make the U.S. side more eager to cut a trade deal."

Anecdotally there are some signs the Chinese economy is getting hit. Apple, for instance, blamed a trade-related slowing in China for a drop-off in iPhone sales.

Barclays economists said the 0.6 percent decline in import prices in December had to do with a decline in energy and imported inflation pressures. Chinese firms may also have responded to trade pressures.

"Anecdotal evidence suggests that in response to tariffs from the US, Chinese firms may be lowering prices in order to remain competitive in the US market," the economists noted. "This would be consistent with monthly import price patterns recently — import prices from China were rising at a modest pace in early 2018, but started to turn negative in the middle of the summer, when trade tensions and tariffs intensified."

Williams said the stimulus being offered by Beijing is smaller than during other periods when the government stepped in.

"There's been a steady drip of announcements, but I think it's important to note that they don't add up to all that much, certainly in comparison with previous bouts of stimulus we've seen from China's government. This time they are not going all in," he said.

"If we compare it with what they did in 2015/2016, the fiscal and monetary stimulus we've had so far is perhaps a quarter of the size. They're still announcing things every couple of days. It's still adding up." Williams estimated the stimulus could be half the size of the last one, but a quarter size the stimulus during the financial crisis.

"I think China is doing what China does best," said Joseph Lupton, global economist at J.P. Morgan Chase. "They inundate you with a ton of headlines, and that's going to provide an extra level of calm to the slowing that's taking place. I don't want to water it down. I think what they're doing ... will have an effect on the economy, but it's not going to have that type of effect after the financial crisis, when they really did bring out the bazooka and boosted growth over the next couple of years."

Lupton said he ultimately expects the U.S. and China to work out a trade deal. But while China may compromise on intellectual property and other U.S. demands, it's probably not going to give on its program aimed at growing in areas of new technologies, "Made in China 2025."