The top House Democrat overseeing the financial industry raised concerns Thursday about BB&T's purchase of SunTrust.

In a written statement to CNBC, House Financial Services Committee Chair Rep. Maxine Waters questioned whether the union of regional banks announced Thursday would benefit customers. The sale that the companies billed as a merger of equals creates the sixth largest lender in the United States.

"The proposed merger raises many questions and deserves serious scrutiny from banking regulators, Congress and the public to determine its impact and whether it would create a public benefit for consumers," the California Democrat said.

Sen. Elizabeth Warren, a Massachusetts Democrat and another fierce Wall Street critic, also questioned the deal on Thursday. In a letter to Federal Reserve Chairman Jerome Powell, she wrote that the Fed board's "record of summarily approving mergers raises doubts about whether it will serve as a meaningful check on this consolidation that creates a new too big to fail bank and has the potential to hurt consumers."

Waters attributed the deal in part to a law passed last year that eased some bank rules implemented in the wake of the 2008 financial crisis. She argued that "this proposed merger between SunTrust and BB&T is a direct consequence of the deregulatory agenda that [President Donald] Trump and Congressional Republicans have advanced."

The measure passed last year eased regulations on all but the largest U.S. banks. Proponents of the legislation — including 17 Senate Democrats — argued in part that it would save community banks from an unnecessary burden.

In a note earlier Thursday, Cowen Washington Research Group analyst Jaret Seiberg said the deal would likely get approved, but noted that congressional scrutiny could disrupt it. Waters "asking so many questions that it slows the evaluation of the deal" poses a risk to it going through quickly, he wrote.

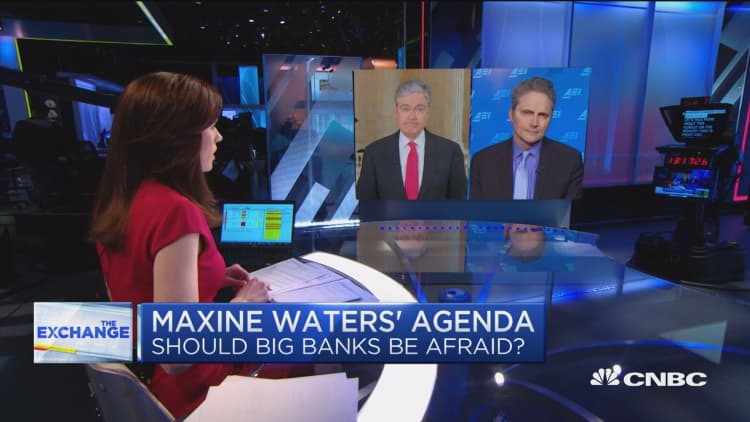

Waters, a vocal critic of big banks, took control of the panel when Democrats regained a House majority in January. Speaking to CNBC recently, she stressed that she can work with the financial industry.

"Even if you know you disagree with a particular industry, you let 'em in and you let 'em talk to you. It's always a learning experience," she said.