Lyft shares hit a new 52-week low on Wednesday as the stock tumbled nearly 11% while investors expect its larger rival Uber to formally file to go public on Thursday. Lyft's drop also follows skepticism about the ride-hailing service's valuation from a top authority.

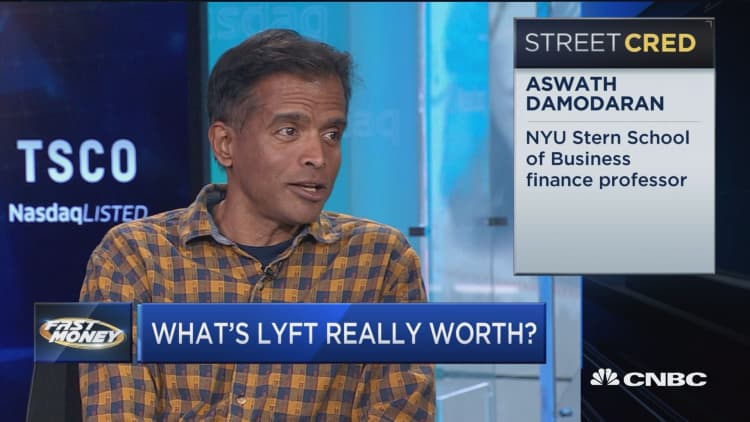

New York University professor Aswath Damodaran said Lyft should be traded closer to $59 per share with a valuation of $15 billion in an interview on CNBC's Fast Money Tuesday. That would wipe about $2.2 billion off its $17.2 billion valuation as of Wednesday and cut its share price by about $1. Wednesday's drop alone shaved about $2 billion from Lyft's market capitalization.

"The driver is a free agent. The customer is a free agent. There is absolutely no stickiness in the business, and they know it. That's the basic problem I have with the ride-sharing business not just Lyft," Damodaran said.

Damodaran's criticism of ride-hailing extended to Uber as well, but the company's valuation is expected to dwarf Lyft's, with Reuters reporting it will seek between $90 billion and $100 billion.

CNBC confirmed that Uber expects to make public its IPO registration on Thursday and plans to sell about $10 billion worth of stock, making it one of the largest-ever tech IPOs.

Lyft has had a tough go during its first couple weeks on the public market. The stock's IPO price was $72, but now stands at $60.12, down more than 14 percent in one week.

-CNBC's Leslie Picker contributed to this report.

Correction: This story has been updated to reflect that Wednesday marked a new 52-week low for Lyft.

Watch: Lyft goes public but has no clear path to make a profit