Stocks rose on Monday amid optimism around U.S.-China trade talks as Wall Street wrapped up a volatile third quarter.

The Dow Jones Industrial Average climbed 96.58 points, or 0.4% to close at 26,916.83. The S&P 500 closed 0.5% higher at 2,976.73 while the Nasdaq Composite gained 0.8% to 7,999.34.

Tech was among the best-performing sectors in the S&P 500, advancing 1.1% as Apple shares rose 2.4% on a price-target increase by an analyst at J.P. Morgan. The analyst's new price target implies a more-than 20% increase for the tech giant over the next 12 months.

In a statement over the weekend, a Treasury spokeswoman said the Trump administration "is not contemplating blocking Chinese companies from listing shares on U.S. stock exchanges at this time." The statement, along with better-than-expected economic data out of China, lifted Wall Street sentiment on Monday.

Wall Street ended lower on Friday on reports that the White House is considering limiting U.S. investment into China, including a possible delisting of Chinese companies from U.S. stock exchanges, in a further escalation of the ongoing trade dispute between the world's two largest economies. White House trade advisor Peter Navarro told CNBC those reports were inaccurate.

Chinese state media called the potential restrictions "the latest attempt at decoupling" and warned of "significant repercussions for the Chinese and U.S. economies, as well as their companies, in the future."

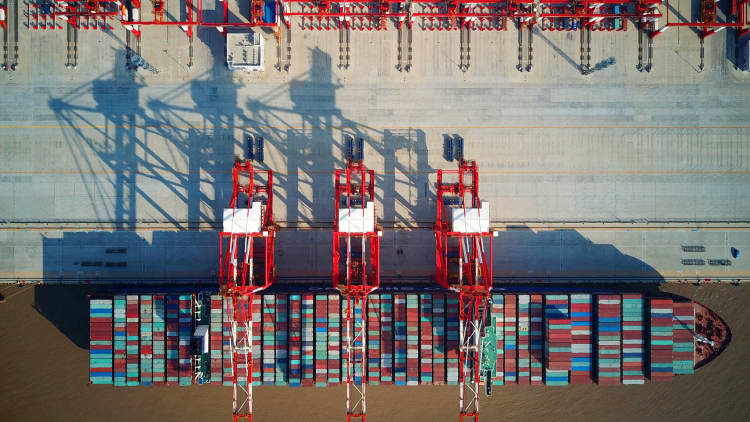

U.S. and China trade delegations are due to meet on Oct. 10 as both sides try to move closer to a deal. Both countries have slapped tariffs on billions of dollars worth of their goods, dampening expectations for economic and corporate profit growth.

"The fundamentals of the U.S. economy remain strong but investors' skittishness has caused stocks to fluctuate with the ebb and flow of news headlines," Doug Peta, chief U.S. investment strategist at BCA Research, said in a note. "The U.S.-China trade war continues to loom as the biggest risk to the global economy and the main source of investor angst."

Peta noted, however: "If hard-nosed trade policy appeared to be pushing the economy in the direction of a recession, it is likely the administration would dial down its aggressiveness."

Volatile quarter

The Dow and S&P 500 gained more than 1% each for the quarter while the Nasdaq dipped 0.1%. It was the third straight quarterly gain for the Dow and S&P 500. However, the quarter was a choppy ride for investors.

The S&P 500 recorded its worst day of the year on Aug. 5, plunging nearly 3% amid worries over the global economy. Those concerns were sparked by weaker economic data and a yield-curve inversion, with the 2-year Treasury yield breaking above it 10-year counterpart.

Fears around U.S.-China trade negotiations also buffeted stocks throughout the quarter.

"It's been a rough ride for sure, but ultimately you're seeing the power of the central banks and the Fed helping support the economic structure as best as they can," said Dan Deming, managing director at KKM Financial. You're also seeing "the tone change around the U.S.-China trade narrative, which is positive."

The Federal Reserve cut interest rates for the second time this year earlier in September while other central banks pointed to easier monetary policy moving forward.

KLA Corp is the best performer of the third quarter in the S&P 500, gaining more than 30% in that time. Western Digital, Target and Lam Research all jumped over 20% in the quarter.

Macy's and Ulta Beauty did not fare so well. Both stocks lost around 30% of their value in the third quarter.

For September, the Dow and S&P 500 were up 1.9% and 1.7%, respectively. The Nasdaq gained 0.5% in September.

—CNBC's Elliot Smith contributed to this report.