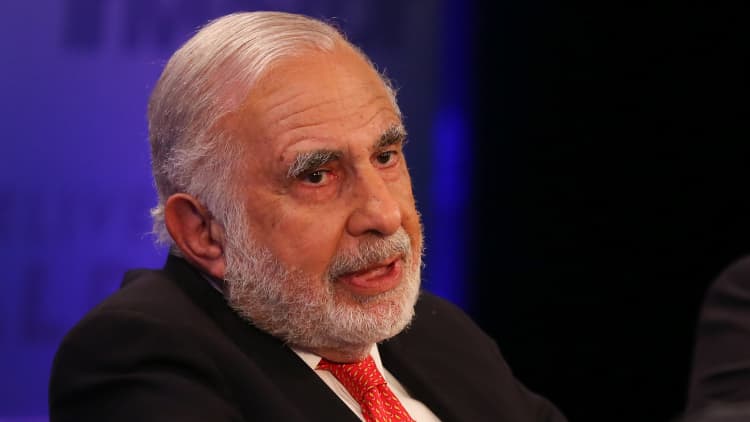

Billionaire investor Carl Icahn said Friday the coronavirus sell-off has made some stocks so cheap they're being "given away."

"Now it's reached a point that there are some companies that are sort of just given away," Icahn said on CNBC's "Halftime Report." "Some of these companies are awfully cheap, they're very cheap."

But Icahn, who was bearish prior to the recent sell-off, doesn't see the turmoil that has sent the Dow and S&P 500 into bear market territory ending just yet.

He said he's "not quite as bearish" as he was, but that he does think "it probably has a longer way to go down."

"I still think my hedges are good. I've been hedged for three years so I'm not getting hurt nearly as much as a lot of other people," he said.

Icahn said that amid the market turmoil, he's been buying stocks, including Occidental Petroleum, Hertz and HP.

"These companies are good companies. Occidental, Hewlett-Packard … there are companies that should be bought. On the other hand, there are many very overpriced companies with very high multiples and too much debt on them and those should be sold," he said.

A regulatory filing on Tuesday showed that Icahn now owns nearly 10% of Occidental Petroleum. Shares have lost 69% this year as oil prices struggle.

Icahn has been a vocal critic of Occidental CEO Vicki Hollub. "I think it's a very good company with an awful board that shouldn't be there," he said.

The Icahn Enterprises chairman also said that he expects the U.S. commercial real estate market will crumble, much like the broader housing market collapse of 2008.

He is shorting the commercial mortgage bond market and it's his "biggest position by far." His short is specific to credit default swaps, or "CDS," which are assets that back the mortgages of corporate offices and shopping malls.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.