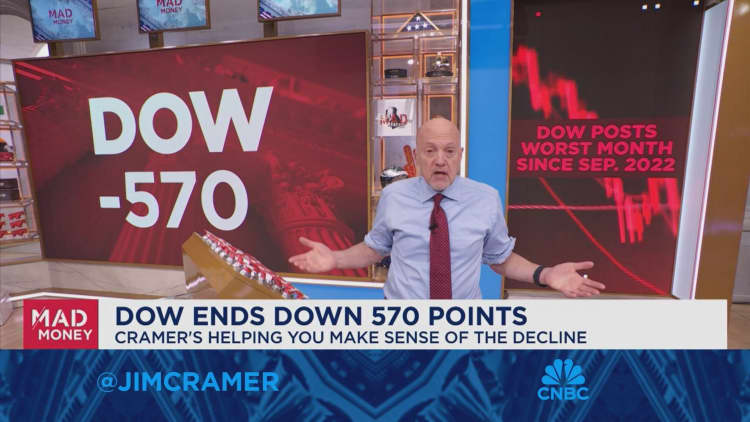

After a generally rough April, CNBC's Jim Cramer parsed Tuesday's market action, telling investors that anxiety about interest rates is a major reason stocks fell at the end of the month.

The major averages had declined by close, wrapping up a particularly disappointing April. All three broke a five-month winning streak, and the Dow Jones Industrial Average saw its worst monthly performance since September 2022.

Cramer emphasized that much of Wall Street's attitude hinges on rate decisions made by the Federal Reserve, whose two-day meeting ends Wednesday. He said investors might have been spooked Tuesday because the Employment Cost Index, which measures workers' pay, increased more than expected.

"What truly matters to this market is that we've got plenty of investors who're still clinging, or holding out for, a whole bunch of rate cuts this year," he said. "And until they give up on that idea, they're going to keep dumping stocks any time we get one piece of strong economic data, no matter what it is."

But he was optimistic that Fed chief Jerome Powell could help calm investors' nerves if his comments on Wednesday suggest policymakers will hold rates steady — and not hike them. Cramer pointed to a survey released on Tuesday that suggested consumer confidence dropped to its lowest level since July 2022. He said this statistic could indicate weaker retail spending, which is something the Fed wants to see. Tuesday also saw data from the latest Chicago Purchasing Managers' Index, which could signal a weakening economy, Cramer added.

"Every year there are people who want to get out ahead of the 'sell in May and go away' crowd," Cramer said. "If that's the case, we could right the ship tomorrow if Jay Powell acknowledges some brown shoots. Personally, that's my preferred explanation."

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com