Natural gas has all kinds of environmental upsides. It is also plentiful and its uses, including new ones, are multiplying. Total has made gas a core focus of its growth strategy, by opting to become an integrated, responsible operator.

A now and future energy

Gas is an abundant resource. The world has 220 trillion cubic meters1 of so-called proved reserves, the ones experts are certain to a probability of at least 90 percent can be recovered using current technology and under current economic conditions. At today's consumption rates and discounting future finds, we can look forward to just over 55 years of gas availability. That's more than oil, but less than coal and uranium, which come in at around double that. Global gas reserves rose by 30 percent between 2005 and 2015 with new offshore discoveries in the Asia-Pacific region, re-evaluations of existing reservoirs, and the development of shale gas and tight gas (particularly in North America).

Global Tour of Planet Gas

The five countries with the biggest proven reserves are1:

- • Russia, with 35 trillion cubic meters, or 18.1 percent of global reserves.

- • Iran, with 33.2 trillion cubic meters, or 17.2 percent of the world's reserves.

- • Qatar, with 24.9 trillion cubic meters, or 12.9 percent of global reserves. Qatar's reserves soared from 8.5 trillion cubic meters in 1995, to 25.78 trillion cubic meters in 2001.

- • Turkmenistan, with 19.5 trillion cubic meters, or 10.1 percent of global reserves.

- • The United States, with 8.7 trillion cubic meters, or 4.5 percent of global reserves.

As with oil, recent technological innovations are enabling gas exploration to reach offshore, Arctic Circle and ultra-deepwater reserves considered difficult to develop before. Today nearly two-thirds of new finds are offshore. Technological innovations are also keeping costs low and increasing productivity for onshore shale gas and tight gas production. IFP Énergies nouvelles (IFPEN) expects production to increase 50 percent by 2020. Potential yet-to-find gas resources could cover up to 120 years of global consumption.

The unconventional gas — shale gas and coalbed methane — revolution has upset the global applecart in the last decade. Found worldwide, in North and South America, China, Australia and Russia, among others, technically recoverable reserves have soared to almost 240 years of consumption1. Many experts believe that unconventional gas resources2 are every bit as sizable as their conventional counterparts.

Global production is dominated by the United States, which is now the world's top gas producer, with output of 750 billion cubic meters in 20163. Today, gas is the country's second-biggest energy resource, supplying more than half of U.S. households. Thanks to shale gas, the United States is becoming one of the world's leading natural gas exporters.

Reserve estimates are tricky given how much reserve volumes change with shifting economic and technological parameters; no one can confirm the accuracy of the figures. Because governments aren't subject to shared standards, only publicly listed oil and gas companies are required to provide exact figures. Yet many of the biggest ones are national oil companies.

As global demand climbs, the energy mix includes more natural gas (a quarter of demand in 20174). According to the IEA, gas will account for the second biggest share, after oil, of the global energy mix by 20402. China alone accounts for a third of gas demand (31 billion cubic meters1). Power generation and industry are — and will remain — the main drivers of this expansion. Gas will increasingly replace coal in both sectors.

Most important, however, natural gas is the lowest-carbon fossil fuel. It emits fewer air pollutants such as PM 2.5, or fine particulates that become suspended in the air; NOx, or gases composed of nitrogen and oxygen; and SOx, or gases made up of sulfur and oxygen. All are harmful to human health and regularly singled out by the WHO (World Health Organization). Greater use of natural gas in transportation, housing and industry will sharply curtail those emissions. Already, big cities such as New York, Toronto, Dublin, Istanbul and Berlin have seen their air pollution rates drop by 69 to 98 percent after natural gas was substituted for heavy fuel oil or coal in industry and power generation5.

Gas also partners well with the growing use of renewables, certain of which suffer from intermittent availability. The operational flexibility of gas-fired power plants — fast restarts and fast build-up to full capacity — makes them a good match for renewables. Natural gas used to generate power emits only half as much greenhouse gas as its energy equivalent in coal. That makes gas an ally in the energy transition to carbon-neutral, less polluting economies.

Gas can also be a renewable energy. Biogas, obtained by treating agriculture, forest or any other organic waste source, has strong future potential. According to France's Association technique énergie environnement (ATEE), 750 million tons of oil equivalent (Mtoe) could be produced worldwide each year via methanation of municipal waste. Using agricultural by products would yield an energy content of roughly 1,000 Mtoe a year, enough to cover global gas consumption.

• For more on the subject: World Gas Conference 2018: The major challenges of natural gas

Gas, a cornerstone of Total's strategy

All these pluses are why gas is now a core focus in the growth strategy of Total, which, as stated in its latest climate report, factors climate change into its strategy. Natural gas as a share of Total's energy mix is expected to jump from 35 percent in 2005 to around 60 percent in 2035. As its Chairman and CEO Patrick Pouyanné often puts it, Total will become a "gas and oil major."

Total's strategy for gas is to be an integrated, world-class player. Total is one of the few industrial operators to have opted for integration across the value chain, from exploration to distribution. First gas on projects such as Yamal LNG in Russia, Ichthys LNG in Australia, Edradour in the West of Shetland area and Glenlivet in the northwest and the deployment of distribution in France via TOTAL Spring and Direct Energy testify to the company's ability to deploy technologies spanning everything from extraction and liquefaction to distribution.

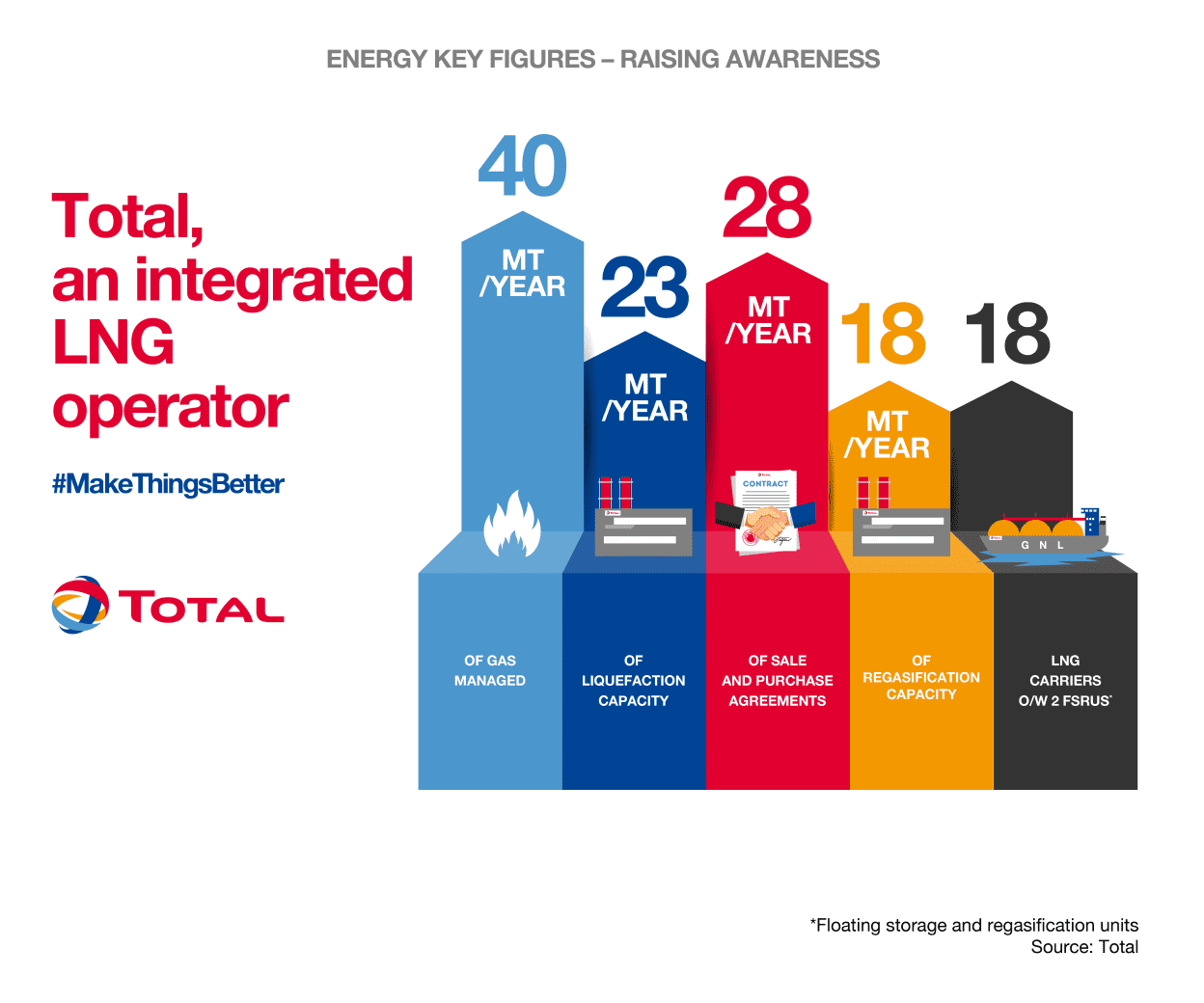

Following the recent acquisition of Engie's LNG business, Total is now the world's second-ranked liquefied natural gas operator, with a market share of around 10 percent (see infographic).

Farther downstream, Total has made strategic acquisitions such as Direct Energie, a supplier of natural gas and power to the French and Belgian markets, and a 25 percent stake in Clean Energy, the leading distributor of natural gas fuel for heavy-duty trucks in the United States. They prove Total's determination to help develop new gas uses, specifically transportation fuels, for cleaner mobility. The contract signed with CMA CGM, the first shipping company to equip its transcontinental container ships with LNG engines, is another example.

For more on the subject: Is natural gas really nothing more than a transition energy?

Lowering methane emissions

Rapid growth won't be possible without controlling the methane emissions associated with producing and transporting natural gas. Methane is a powerful greenhouse gas with a global warming potential (GWP) that the IPCC says is 25 times higher than CO2 over 100 years. So cutting emissions, mostly from leaks and releases (flaring and venting), is imperative to fight climate change.

At the most recent OGCI6 CEO's conference, held on September 24 in New York, member companies set a goal of reducing the methane intensity of their gas operations by 20 percent by 2025.

For its part, Total is involved in the Climate & Clean Air Coalition7 and its Oil & Gas Methane Partnership. This initiative, which brings together several oil companies8, governments and NGOs, promotes the measurement, monitoring and reporting of methane emissions.

Still a relative newcomer to the global energy mix, natural gas will gain ground in a mix that is changing. It can address growing global demand and climate challenges at the same time.