The Federal Reserve met market expectations Wednesday with another round of easing, this time with a pledge to keep interest rates low until unemployment falls below 6.5 percent and inflation tops 2.5 percent.

Economists had been expecting the Federal Reserve to accelerate its debt buying program, known as quantitative easing, to the tune of another $45 billion a month, and the central bank came through.

Coupled with its move to buy $40 billion of mortgage-backed securities a month, that would bring the Fed balance sheet expansion to another trillion dollars or so in 2013 and $4 trillion overall.

The move essentially keeps the Fed in the easing business indefinitely, as the jobless rate has been stubbornly high for the past four years and shows little inclination lower except for statistical gyrations caused by people leaving the workforce. (Read More: Job Creation Hits 146,000, Rate at 7.7%)

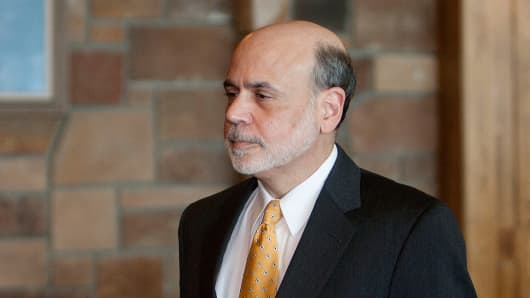

Fed Chairman Ben Bernanke pointed out at an afternoon news conference that even after the employment and inflation targets are triggered, that won't lead to an automatic raising of rates.

He also expressed fear over the "fiscal cliff" of tax hikes and spending cuts set to take place automatically at the end of the year. Bernanke said even the Fed's massive balance sheet expansion wouldn't be enough to stave off the effects, though the Fed may accelerate its asset purchases should cliff take effect.

"We cannot offset the full impact of the fiscal cliff," he said. "It's just too big given the tools that we have available and the limitations on our policy toolkit at this point."

In its statement, the Fed's Open Market Committee said the economy is growing gradually but needs assistance in the form of the dual measures it agreed to at its final meeting of 2012.

"Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative," the committee said. (Click here for the full Fed statement.)