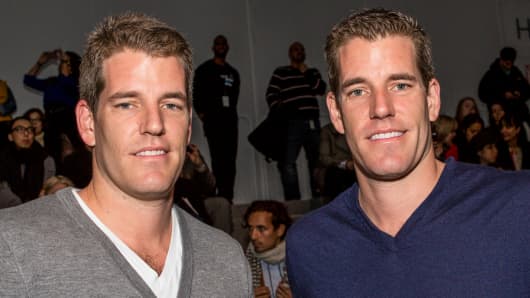

The bitcoin has been getting a whole lot more attention since the Winklevoss twins—who famously alleged that Facebook founder Mark Zuckerberg stole their website idea—last week revealed plans to launch an ETF to track the virtual currency.

But while the fund would be aimed at giving mainstream investors a simple way to bet on the currency, many investing pros doubted the concept will work.

The big problem, these critics said, is that while bitcoins have become wildly popular among some tech-savvy investors and consumers, it's unclear regular investors will go for so much exposure to an asset class the world is still trying to get its head around. "If I gave my girlfriend a bitcoin instead of a diamond necklace, would she slap me across the face or thank me for this thoughtful gift?" asked Brett Gordon, a professor at Columbia Business School.

Others doubt the exchange-traded product will even make it past the regulators and onto the market. "Anything that competes with the U.S. dollar is illegal," said Paul Baiocchi, ETF specialist at Index Universe. (The Winklevoss twins have filed documents to the Securities and Exchange Commission to launch the fund.)

Even some admirers of the bitcoin concept admit a fund dedicated to the currency might be jumping too fast, too soon. "Bitcoin is a truly innovative model, but we're still very much in the hacker stage of development," said David Teten, a partner at ff Venture Capital and founder and chairman of Harvard Business School Alumni Angels of Greater New York.

Teten added that bitcoin is "version 2.0" of the next generation of currencies," and that it's backed by absolutely nothing other than a belief system that bitcoins are valuable. "That means there's no floor to how low the currency can go," said Teten.

(Read More: Bitcoin ATM Gets Ready for Roll Out)