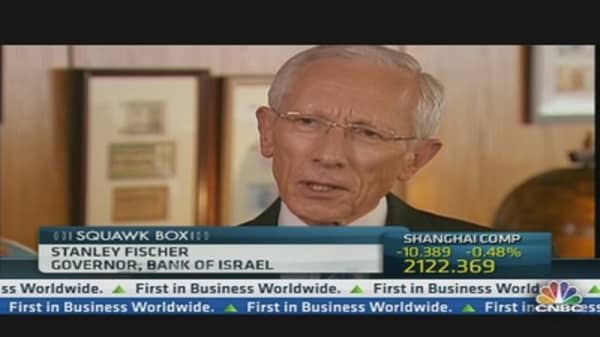

The global economy is "close" to a recession despite mass liquidity injections, Stanley Fischer, the head of the Bank of Israel told CNBC, though he added that it wasn't clear if the economy would actually enter one because of a small improvement in confidence recently.

"Stock markets are up, possibly (because of) QE3 in the United States, the new policies of the ECB, Bank of Japan, Chinese have done something to the financial markets, so we may be seeing improvement, but it was going down before that," Fischer said in an interview in Jerusalem.

The former chief economist of the World Bank and former vice chairman of Citigroup, who was tipped as a potential head of the International Monetary Fund (IMF) before Christine Lagarde's election, was cautiously optimistic about the impact of a third round of quantitative easing (QE3) by the U.S. Federal Reserve.

"The empirical evidence is that it's actually quite effective, and we'll see. This one is aimed very much at the mortgage markets, and housing had already been making a comeback in the United States so this might give it a push," he argued.

Uncertainties about fiscal policy are having a major impact on the U.S. economy, he said.

"They have to deal with the fact that they have an unsustainable deficit and it's clear from the polls that the uncertainties about fiscal policy are having a major impact on how people think about the future of the economy," Fischer said.

"It'll be good to get a plan for dealing with it on the table, one that's credible, so the sooner the better, but obviously not before the elections. But it would be good if they were able to reach an agreement on what to do."

Amid rising tensions in the Middle East, Israel was one of the flash points in Monday night's final U.S. presidential election debate. President Barack Obama was accused by challenger Mitt Romney of not paying enough attention to Israel, which he hasn't visited since attaining the Oval Office.

As the rest of the world frets over whether Israel will launch a pre-emptive strike against Iran to stop it gaining nuclear weapons, Fischer wanted to leave the debate to the political leaders in Jerusalem, but he added that the central bank was prepared for any worsening of tensions.

"We plan for all sorts of eventualities but I'm not going to go into them," Fischer said.

The specter of Iranian nuclear power – and economic sanctions against the state - was raised again over the weekend when the New York Times reported that Iran is ready to talk to the United States about its nuclear program.

"My guess is that sanctions will continue to be tightened as long as the Iranian program seems to be proceeding rapidly," said Fischer.

He added that there had been a "serious deterioration" in Iran's economy but does not think an economic collapse is inevitable.

Fischer said he is trying to free up international funds for Palestine, one key flashpoint for the Middle East, through talks with the IMF.

"It's clear that the situation they're in has to be normalized in one way or another. It's an economy, which if trade were free with Israel and there were no security problems, could do very well," he said.

"And there are talented people and highly educated people and so forth so that could happen but it's very difficult in the current situation for them to succeed without getting some kind of foreign aid."

The Israeli economy will continue to be Fischer's main focus. Prime Minister Benjamin Netanyahu has called early elections in a bid to win voters' backing for a budget which would raise taxes and government spending.

"The problem is that they've committed to a variety of groups and political parties and what have you to increase spending by 10 percent in 2013 so they've got to cut 5 percent out of their promises," said Fischer.

"We calculate this will be a slightly restrictive budget because the tax increase effect will outweigh the 5 percent increase in spending."

A recent report from the central bank raised the specter of a possible housing bubble and Fischer says he is fully aware that lower borrowing costs could further inflate house prices in Israel.

"We are very committed to not allowing a bubble to happen and we will undertake measures if we have to prevent that from happening," said Fischer, who noted if he is forced to cut rates again he may have to introduce measures that stop such a move leading to further increases in house prices.