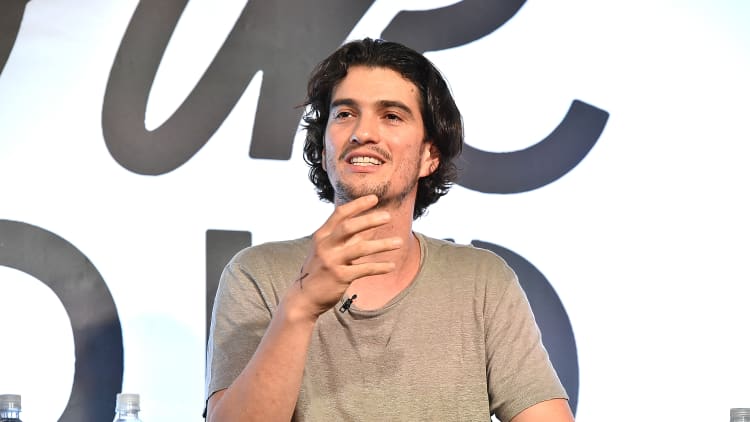

Former WeWork CEO Adam Neumann will get up to $1.7 billion to walk away from the company and give up his voting rights, according to people familiar with the matter. SoftBank will pay Neumann up to $970 million for his shares, a $185 million consulting fee and will offer him $500 million in credit to help repay his loans to J.P. Morgan Chase, UBS and Credit Suisse, said the people, who asked not to be named because details of the agreement are private.

SoftBank is in advanced talks to take control of WeWork, a decision that could come as soon as Tuesday, CNBC reported on Monday. The deal would value WeWork between $7.5 billion and $8 billion on a prefunding basis. WeWork's valuation was roughly $47 billion before its failed IPO. SoftBank will make a tender offer of up to $3 billion for WeWork equity along with a $1.5 billion acceleration of equity it has already committed. Additionally, SoftBank has put together a $5 billion syndicated debt package, CNBC reported Monday.

J.P. Morgan will receive a $50 million fee for raising $5 billion WeWork won't use for financing purposes, one of the people said. A bank spokesperson declined to comment.

In its IPO prospectus, released in August, WeWork revealed revenue of $1.54 billion and a net loss of more than $900 million for the first six months of 2019. Neumann stepped down as CEO and gave up some of his voting power on Sept. 24 before WeWork its pulled its S-1 filing on Sept. 30. Without a cash infusion, WeWork would run out of money by mid-November.

Before WeWork's troubles began, Neumann cashed out at least $700 million through share sales and loans borrowed against his stock.

The Wall Street Journal first reported the details of Neumann's exit package.

— CNBC's David Faber contributed to this report.