Market conditions are ripe for transitioning to electric mobility. Technology, prices, public policy and newly won over automakers are all combining to create a tipping point predicted for a decade from now. Yet questions persist concerning whether users — both businesses and consumers — will adopt electric vehicles en masse. It's an opportunity for Total, which is adapting its business model to create value across the mobility chain and has already demonstrated solutions that work.

Half of all cars EVs in 2030

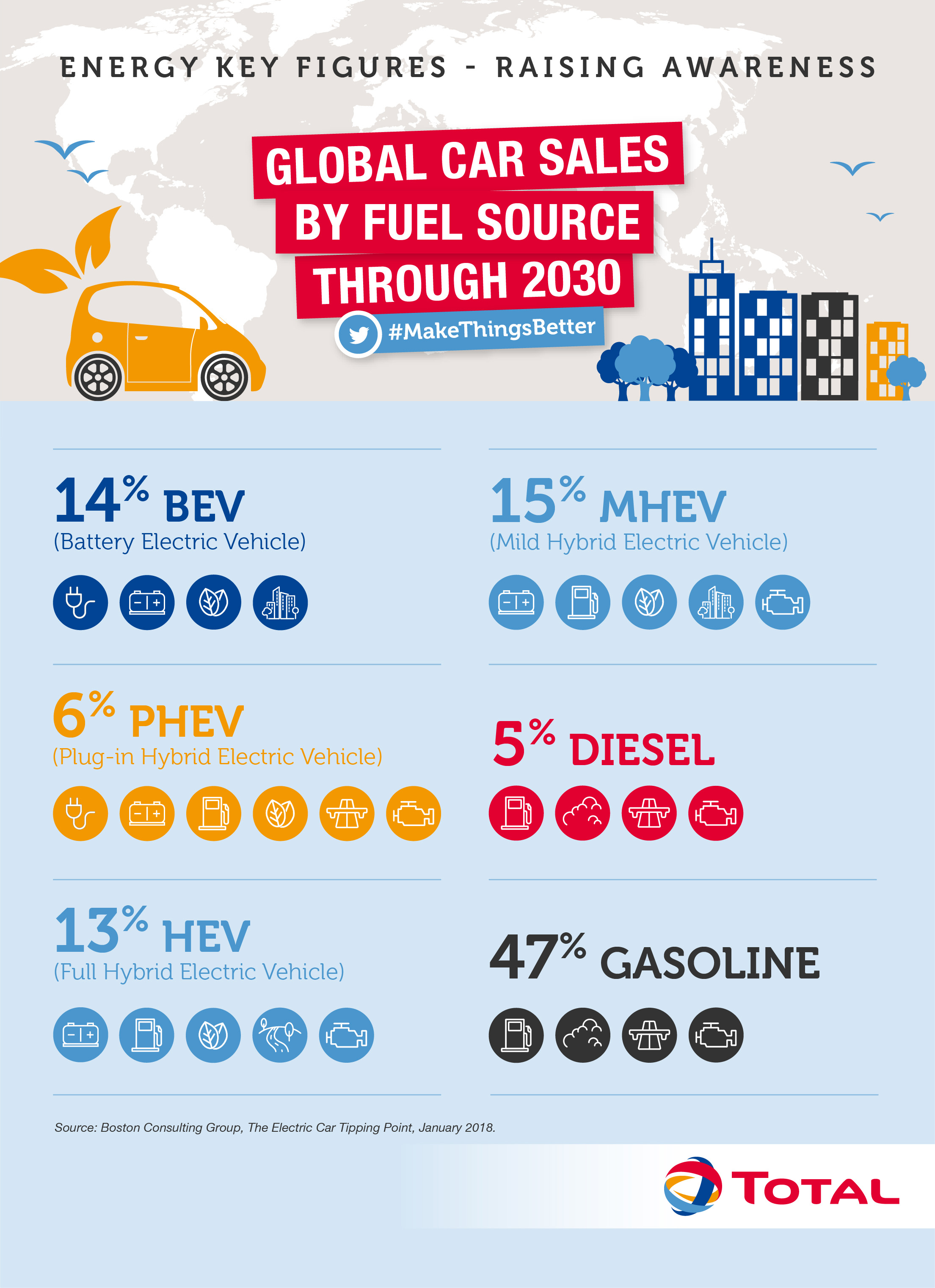

One hundred and twenty years after the Henry Ford revolution in 1908 that ushered in mass production of vehicles, bringing cars within reach of everyone, automobiles are experiencing a second major revolution: a gradual shift away from internal combustion engines to hybrid or all-electric vehicles. According to a recent Boston Consulting Group study, "The Electric Car Tipping Point," 2030 will be the watershed year. The date — just over a decade away — may seem optimistic given a current global fleet numbering only three million EVs out of a billion vehicles on the roads. That's less than 5 percent.

Several factors are set to speed things up. Already, sales of electric cars jumped 54 percent in 2017, according to an International Energy Agency report.

A look back at Movin'On 2018, the World Summit on Sustainable Mobility, at which Total spoke about what a successful transition to electric mobility will take.

A spectacular drop in battery costs. According to a BloombergNEF study, electric car prices could match those of equivalent internal combustion engine vehicles in 2024, and fall below them just one year later. The large-scale production of lithium batteries — and the accompanying decrease in costs — will be the main reason for this minor economic revolution. More specifically, battery prices are expected to plummet from $208 per kilowatt-hour in 2017 to $70 by 2030. That's a 66 percent reduction. Since the battery accounts for 25 to 50 percent of an electric vehicle's cost, this economic feat is without a doubt the main driver of the EV market's health.

Proactive public policies. Policies are increasingly moving in the direction of mass adoption of electric vehicles. Urban pollution from auto exhaust is a serious public health issue, with 7 million deaths a year attributed to air pollution according to WHO, and greenhouse gas emissions are responsible for climate disruption. Both are in the hot seat. But a wide range of initiatives are possible, from positive or negative incentives, such as purchase rebates or restricting or banning internal combustion engine vehicles from the road. Then there is investment: many EV charging stations wouldn't exist without public spending. An example is the Netherlands, where 30,000 of them are already in service. The countries of Northern Europe were the earliest and most effective adopters. Electric cars account for 39 percent of new vehicle sales in Norway, 12 percent in Iceland and 6 percent in Sweden1. China, which is dealing with extreme pollution, is now the country with the strongest growth in electric vehicles. Their market share will skyrocket from a tiny 3 percent today to 28 percent in 20302. Mind you, the Chinese government has imposed a hybrid or electric vehicle quota on automakers, effective in 2019. The 13th five-year plan (2016-2020) also sets very specific goals. Fuel consumption by internal combustion engines must drop from 6.9 liters to 5 liters per 100 kilometers in 2020 and 4 liters in 2025, and the energy density of the batteries used in EVs increase from 115 Wh/kilogram to 260 Wh/kilogram.

Changing consumer habits. Gradually, the "reasons to hold back" will fade away. Technologically, vehicles will offer ranges — over 350 kilometers without a charge — that will allay concerns about dead batteries. From a marketing standpoint, EV models will offer all the conveniences, features and enjoyment motorists expect. And in terms of economics, prices will come down and ownership will increasingly give way to rentals, sharing and à la carte consumption. Automakers have already understood and planned for this shift to electric. So the market will undergo a revolution too, including the arrival of newcomers who will challenge established operators. There's Tesla, of course, but also giants such as Apple, which had long dropped strong hints that it was designing an autonomous electric car, and Dyson, which plans to invest £2 billion in a project scheduled to launch in 2021.

Carmakers are responding to the change. All have begun to produce electric models. That includes legendary sports cars. Just two years ago, a senior executive attending the Geneva Motor Show said that an electric Ferrari was "almost an obscene concept." And, referring to self-driving cars, "Over my dead body!" Yet Ferrari's future electric model is expected to be out at end-2019.

The electric car has won. And its victory will sweep away many things associated with internal combustion engines in the last 100-plus years, including noises, smells, physical sensations and freedom. While creating new ones.

- For more on the subject: Addressing the Challenge of 1.8 Billion Cars in 2035

The necessary transformation of energy companies

But all that's still a few years away. Antoine Tournand, vice president, Retail Network at Total Marketing & Services, stresses that "the transition to electric will happen gradually, over a 20-year period. You don't create a new world overnight. Whether you're talking about end consumers (B2C) or company fleets (B2B), the adoption of electric vehicles will also have to reckon with everything that entails in terms of changes to habits and behavior. For all the enthusiasm and promises, there are constraints and the transition will take time." Time for suppliers of conventional energy — read oil and gas — to adapt to the new reality. "Total has an enviable role and position," says Antoine Tournand. "Four million customers in Europe, 3.5 million payment cards and, most of all, an increasingly broad approach to mobility, including toll and parking payment and managing business fleets. The change under way has not caught us flat-footed."

In fact, Total recently acquired Belgium's Lampiris3 and France's Direct Energie4, two companies that produce and market5 green power. "Both are very knowledgeable about the electric power ecosystem. By pooling their know-how with that of our GRP6 segment, Total can provide an all-in-one solution combining EVs and current and future fleet management. That's how we plan to become a relevant and expert mobility resource to make people's lives easier."

In addition to adjusting its strategy, Total is also taking an interest in the human side of the transition. To that end it held a working session at the Movin'On 2018 summit in Montreal entitled "Successful Transition Towards Electric Mobility." The session aimed to understand and identify the key points to consider in the transition to electric mobility. "The main challenge is change management, getting people on board," says Antoine Tournand. "It's not just a matter of infrastructure and vehicles. It also comes down to individual attitudes, which must adapt to a system in which cars are no longer something you own and that let you go anywhere, and figure out where they fit into a process of smart mobility. People too often only address the aspects linked to material obstacles, overlooking attitude-related issues."

So electric mobility's challenge is to succeed in a business model that puts mobility ahead of energy. The Total executive confirms this: "Total's future vocation isn't to 'cling' to making money by supplying energy. It's being active in the value chain of electric mobility and charging station management."

In a world with more and more connected vehicles, Total is in the process of also becoming a fleet manager providing services and offering other mobility solutions, especially digital. "The opportunities are almost limitless: if we're the first to embrace digital, we'll have a larger market share." To give an example, Total recently acquired an interest in the start-up WayKonect7, which has developed a technology to gauge vehicle condition and track driver safety and eco-driving performance, to help fleet managers save big on fuel. Driver behavior is the leading source of savings.

"The energy transition and, even more so, the transition to smart electric mobility requires support, advice and monitoring. It's an opportunity to create value," notes Antoine Tournand. "We'll have to be able to answer the question 'How do I get my company's employees to buy in?' In other words, resolve a multitude of specific cases. If you can't do that, it won't work!"

- For more on the subject: Seven Sustainable Mobility Solutions That Work, in Less Than 10 Years .

A full-scale experiment at Lampiris in Belgium

Lampiris is a Belgian company set up in the early 2000s when the European Union deregulated its electricity and gas markets. It is clearly positioned as a green energy supplier. Total acquired it in September 2016. Nicolas Paris, head of product development, Electric Vehicles at Lampiris, remembers that "Electric mobility became a hot topic at the time of the takeover. It's kind of like our 'baby.' With Total at our side, we had had the necessary credibility, and we really wanted to get on board and see how far we could take it."

So the Liege-based company has gradually switched over its 80-vehicle internal combustion fleet to make it more electric. "We already have five electric vehicles and have ordered another 15," says Nicolas Paris. "By end-2018, 25 percent of the fleet will be electric and by 2021, all of it will be." The company is committed to pioneering in this area. Lampiris's CEO was the first to "take the plunge," showing the type of leadership that makes a difference in obtaining buy-in from all of the company's employees. "Embracing electric vehicles reaffirmed Lampiris's longstanding values: to pioneer and to challenge the status quo in sustainability and green technology," comments Nicolas Paris.

But things are more complicated than that. For all the stated goals, daily obstacles are all too real. "The biggest impediment is the types of vehicle available. The supply isn't yet varied enough to suit to every individual situation: family size, type of trips, both planned and unexpected," notes Lampiris's Head of Product Development. Charging is still what drives anxiety about buying an EV. Whether the focus is on the availability of charging stations, which aren't always found at detached homes and apartment buildings, a still-underdeveloped charging infrastructure8 or meeting the needs of people who may travel 150 kilometers a day. "First we have to look for situations that work well," advises Nicolas Paris. "Then move on to individualizing policies. Things have to progress gradually; we've created a four-year plan."

For now, the results of the experiment are fairly positive. "It's still a little early to say it's a total success, but we feel we're EV pioneers and are convinced the transformation to electric can be applied to other company fleets. The trend isn't going to reverse itself, and each day we're showing that it works and that we won't go back," says Nicolas Paris.

A certain sense of pride can be felt among employees and personal experiences are shared on internal social media. "You can sense a healthy spirit of competition and buy-in that trickles down even to our customers, with whom we share the 'Lampiris case.' It's a real marketing asset." An asset that was cemented by winning the Green Fleet Award in June in recognition of the Belgian company's initiative.

There's no doubt the automotive landscape will have been reshaped a decade from now. Hybrid or all-electric vehicles will have swept aside the "longtime" obstacles — range, price and model variety — hindering their growth. The next step will be cultural, namely the consumer adoption of vehicles whose characteristics and modes of use will never be the same again.

1 Source: International Energy Agency (IEA).

2 Source: Boston Consulting Group, The Electric Car Tipping Point, January 2018.

3 Lampiris is an independent supplier of gas, green power and energy services such as insulation, furnace maintenance, wood and pellets for heating, and smart thermostats. Lampiris is the third-largest supplier in the residential energy market in Belgium

4 With Direct Energie, Total accelerates its ambition in gas and electricity in France and Belgium

5 Distribution is still controlled and handled by a state-owned company.

6 The Gas, Renewables & Power segment was created in mid-2017.

7 Link in French only.

8 Total is investing in a network of 300 fast charging sites in Europe.